non filing of income tax return consequences

Registered Address Change INC22 Bank Account Assistance Services. Thats 5 of the balance for every month you dont file.

What Happens If Itr Is Not Filed What Are The Consequences

Applicable fines for delay in filing non-filing of Indian ITR.

. The various losses incurred by an individual or a firm in terms of business losses both speculative as well as non speculative capital losses both short term as well as long term and various other types of losses which have not been reflected. The consequences of not filing a personal income tax return include fines liens and even imprisonment. First know what the due date for Income Tax Return filing is.

Taxpayers who missed filing their returns by 31 July. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. Penalty us 270A which is equal to fifty per cent of.

Companies Act 2013 require every Company to file its Annual Return and Financial Statements with the Registrar of Companies containing information as prescribed in this regard within 60 days from the date of. The income tax return is filed for the whole financial year ending on 31 st March of every year. Tax evasion is a serious offense that will leave you with a court hearing marks on your credit and a criminal record.

There are several disadvantages of not filing the tax returns on time under the various provisions of the income tax department. The last date to file returns for the financial year is July 31st. May lead to Best judgment assessment by the AO us 144.

Penalty provisions for non-filing of Indian ITR Transfer Pricing TP Report. Ignoring bills and notices from the IRS can lead to a determination of tax evasion. Filing of revised return us 139 5 of the IT Act cannot be facilitated if the original return us 139 1 has not been filed.

2 days agoWhat happens if you do not file your income tax return by July 31 See here 2021 22 ರ ಹಣಕಸ ವರಷದ ಆದಯ ತರಗ ರಟರನ ಸಲಲಸಲ ಜಲ 31 ಕನಯ ದನವಗದ ನಮಮ ಆದಯವ ರ 2 5 ಲಕಷಕಕತ. Carry forward of Losses not allowed except in few exceptional cases. Failing to file a tax return when you.

C onsequences of non-filing of Income Tax Return. 100s of Top Rated Local Professionals Waiting to Help You Today. Non filing of returns attracts penalty as follows of Rs.

Next Financial Year. In case if tax payable is nil that is all tax has been deducted at source individual can still. If you owe taxes and fail to pay them you could face penalties for failure to pay.

In this article Munmun Kadam of Rajiv Gandhi National University of law discusses Legal consequences of non-filing of Income tax return. Pay 0 to File all Federal Tax Returns Claim the credits you deserve. The return for FY.

Auditor Appointment ROC Filing ADT1 Business Commencement filing Form 20A PF and ESI Support Services. However for small taxpayers if the total income of the person is less than Rs. Consequences of Non-Filing of the Income Tax Return If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty of Rs.

Due Date of Filing Income Tax Return for an NRI The due date of filing income tax return for the financial year 2012-13 is 31st July 2013. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. This penalty maxes out at 25.

Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. Belated Income Tax Return Filing for Assessment Year 2022-23 Latest News. Thus Non-filing of Income Tax Return may result in.

If you file at least 60 days late your minimum penalty is the lesser of. It is usually a predefined worksheet. Given the Income-tax norms an individual is liable to pay Rs 5000 if a return is provided on or before December 31 of the assessment year.

Applicable fines for delay in filing non-filing of tax return a INR 5000 US 75 if the return is furnished after the due date but on or before 31 December of the year following. Prescribed penalty plus imprisonment of at least 3 months extendable up to 2 years. In this article we will look into the details of TCS return its filing and consequences of non.

Ad Does Tax Season Stress You Out. The consequences of Non-Filing of Annual Return and Financial Statements are severe and one must be aware as well as cautious in this regard. There you go with a comprehensive guide on the various penalties for delayed tax return filing.

Every year the IRS and the media put out lots of information and reminders about the due date for filing your federal tax return. However following must be considered. Income tax return filing last date for AY 2022-23 was 31 July 2022.

5000 along with interest us 234A 234B and 234C accordingly. The penalty will rise to Rs 10000 if the taxpayer files the return in the subsequent year between January 1 and March. Best Company Can Help You Find Top-Rated Tax Services Now.

2017-18 is filed in the assessment year AY ie. If you fail to file a Federal tax return by the due date you face a failure-to-file penalty if you owe taxes. The person filing for a TCS return must follow the process laid down in the Income Tax Act 1961.

As per Income Tax Act 1961 a person must file TCS return failing which he will be penalized under sections 234E 271H of the Income Tax Act 1961. In the case of AY 2022-23 the penalty of Rs 5000 will be levied if you file your ITR after the due date of July 31 2022 but before December 31 2022. This Tax Season Use Best Company To Compare Information and Ratings On Top Companies.

Ad Finding a tax return consultant in your area is easy with Bark. Understanding Income tax with these five points An income tax IT return is the tax form or forms used to file income tax with the Income Tax Department ITD. A penalty of Rs 5000 will be charged for the delay in filing returns if the total income is reported Rs 5 lacs.

The failure to file before concerned due date leads to face many consequences by the assessee. For possible tax evasion exceeding Rs25 lakhs. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1.

If the taxpayers do not file the income tax return then they would dissolve their.

For How Many Previous Years A Taxpayer Can File Income Tax Return Income Tax Return Income Tax Tax Return

Consequences Of Non Or Late Filing Of The Income Tax Return

1 43 Pm 12 14 2019 Hamna Only A Filer Can Purchase Property Worth More Than Rs 5 000 000 A Non Filer Can N Income Tax Return Tax Return File Income Tax

Filing Late Tax Returns Cra Charges Penalties Liu Associates Edmonton Calgary

Tds Return Filing Types Of Tds Returns Online Filing

Income Tax Filing India Itr Filing Taxation Policy In India

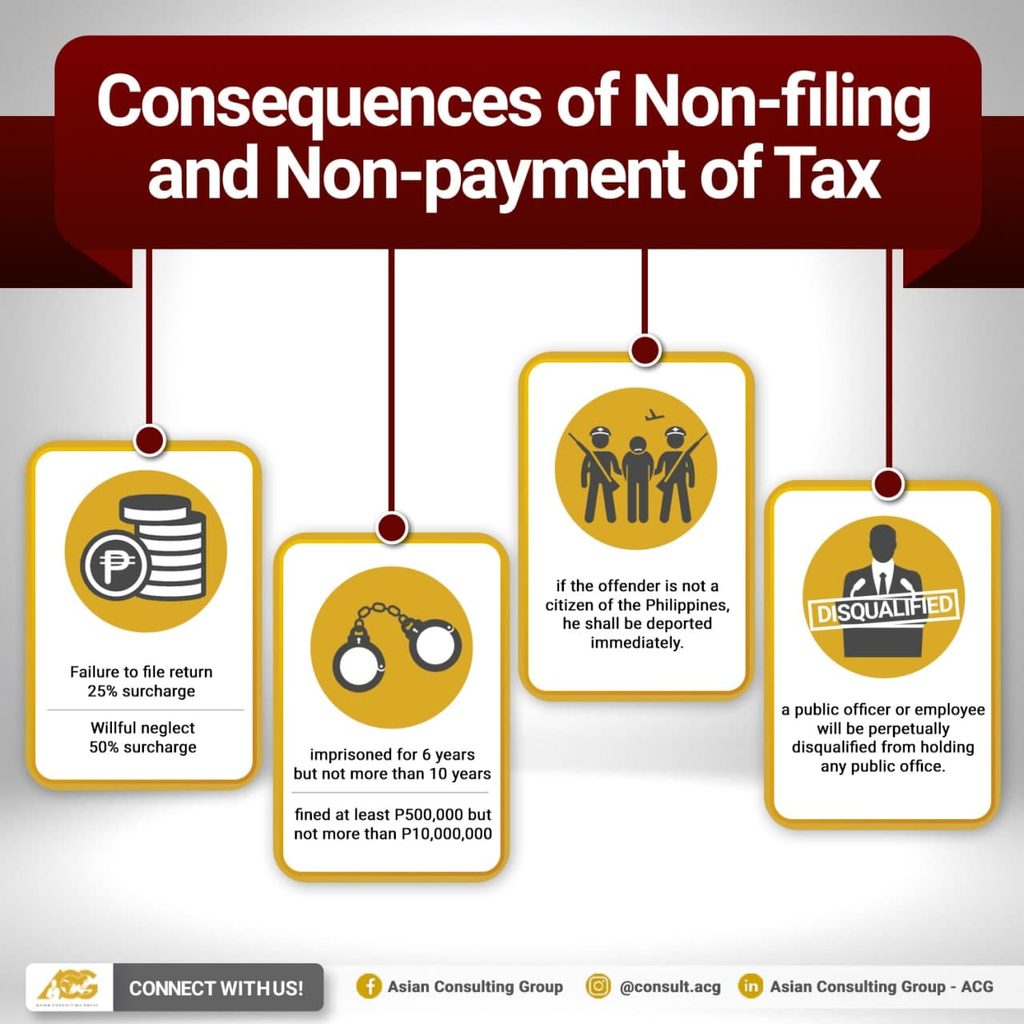

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

Penalty For Late Filing Of Income Tax Return For Ay 2020 21 Income Tax Return Income Tax Tax Return

What Happens When A Taxpayer Do Not File Taxes Filing Taxes Tax Preparation Services Income Tax Return

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

The Season For Income Tax Returns Is Around The Corner And You All Must Be Gearing Up To File Your Income Tax While Fi Income Tax Income Tax Return Tax Return

Fact Doyouknow Knowyourrights Law Food Foodtem Notinagoodcondition Jail Taxolawgy Justiceforall Social Cause Freelancing Jobs Facts

Is There A Penalty For Filing Taxes Late If You Don T Owe Late Tax Filing Liu Associates Edmonton Calgary

What Is Tcs Calculator Income Tax Return Income Tax Tax Payment